Understanding Financial Health: Altman’s Z, H Score, and Argenti’s A Score

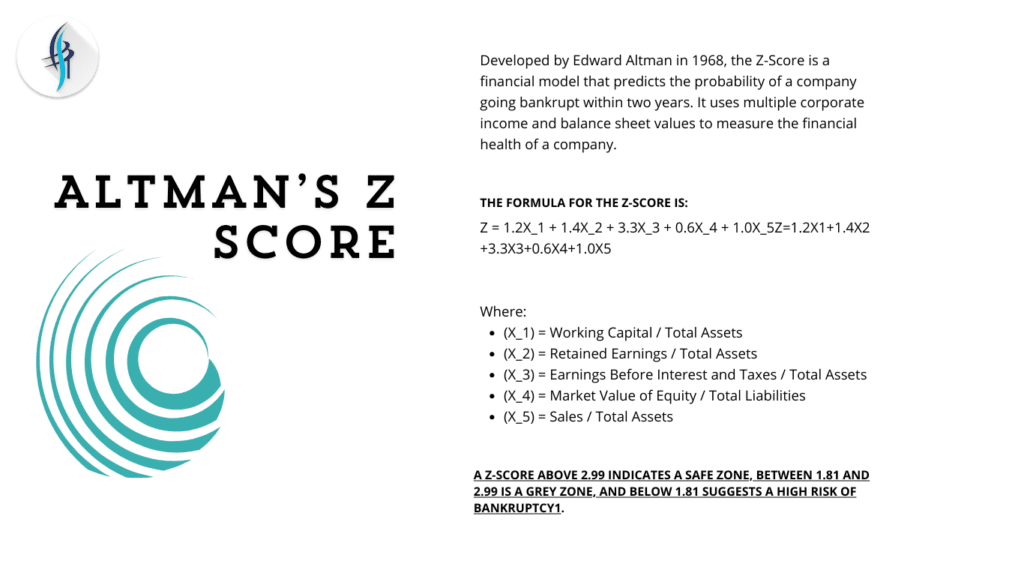

In the field of financial analysis, evaluating a company’s stability and health is essential. Altman’s Z-Score, H Score, and Argenti’s A Score are three well-known models that are employed in this context. With the aid