CA IPCC Result

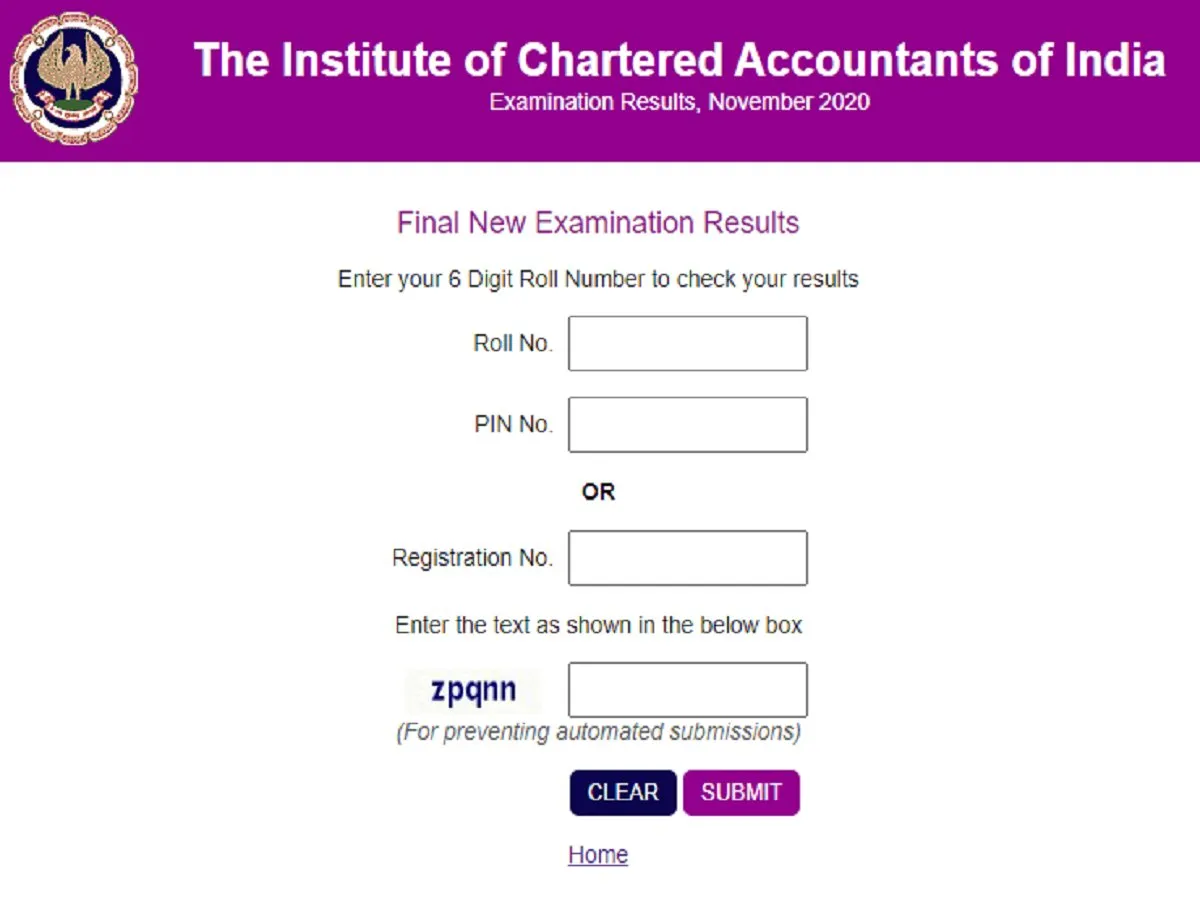

CA IPCC Result The Institute of Chartered Accountants of India (ICAI) can declare the much-awaited CA IPCC result for might 2019 communication within the third week of Gregorian calendar month 2019 (tentatively) together with CPT

CA IPCC Result The Institute of Chartered Accountants of India (ICAI) can declare the much-awaited CA IPCC result for might 2019 communication within the third week of Gregorian calendar month 2019 (tentatively) together with CPT

CA Intermediate GST (IPCC) Classes The objective of this document is to summarize all the updates of CA Intermediate GST Classes (CA IPCC) (Notifications, Circulars, other amendments, and updates) in one place.2 Central tax notifications,1

ICAI CA CPT, IPCC & CA Final | CA Online Classes ICAI CA Online Classes Benefits 1. Versatile Timings – Definitely, CA Online classes is a good option. Students can enjoy ICAI CA Classes (CPT/IPCC/CA

ICAI- IPCC Exam & IPCC Result IPCC is the second level of ICAI Exams. Preparation for ICAI Exams requires a lot of efforts. If students efforts are in the right direction then he/she will surely

ICAI Exam- CPT/IPCC/FINAL The ICAI Exams (CA Exam) are conducted by the Institute of Chartered Accountants of India (ICAI) to generate chartered accountants in India. Candidates who wish to be Chartered Accountant, are required to