ICAI Study Material vs Coaching Material: Getting it Right for CA Success

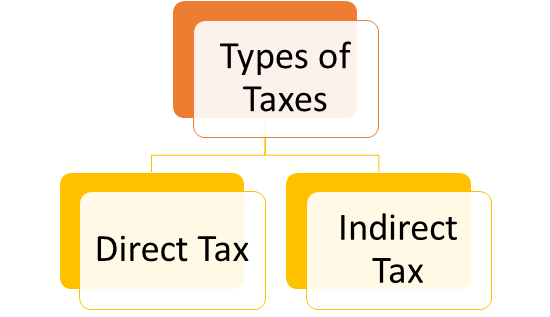

Introduction If you are preparing for the Chartered Accountancy (CA) exam, one of the most important choices for students is which study material to use. For years, the question of whether ICAI study material or coaching material is best has been debated, but the truth is simpler than most acknowledge: ICAI study material should be considered paramount, with coaching material being a useful complement. Why ICAI Study Material is Supreme The Pillar of Excellence– Built-in Learning Features ICAI study materials utilize learning aids such as charts, statistical presentations, and flowcharts to present ideas in a clear and easy-to-understand format. Every chapter is prefaced by learning outcomes that indicate what the students are supposed to know and learn, followed by practical examples and practice questions that reinforce concepts. The Role of Coaching Material: A Welcome Supplement– Although ICAI study material provides the base, quality coaching material is a valuable add-on that can make a big difference in a student’s preparation. What is required is knowing that coaching material must supplement, not substitute, ICAI material. What constitutes quality coaching material Organized Learning Environment Institutes of coaching offer a properly organized syllabus which is developed to cover each syllabus point systematically. Such systematic treatment is especially helpful for students who like to have a planned study schedule and systematic treatment of the huge CA syllabus. Experienced instructors in coaching centers provide individualized guidance and elucidation of intricate subjects based on their years of teaching and professional expertise. Such mentoring can prove to be extremely helpful in supporting students to overcome challenging concepts and acquire suitable exam preparation strategies. Parag Gupta Classes: Excellence in Coaching Material Among the coaching centers that offer top-notch supplementary material, Parag Gupta Classes is one of the finest institutes for CA students. The institute has earned a good name for itself as a rank holder and top scorer-generating institute due to its comprehensive strategy for CA preparation.[6][7][4] What Makes Parag Gupta Classes Unique Parag Gupta Classes provides some benefits that make their coaching material particularly effective: The institute’s mobile app and web portal offer exhaustive course content listings, which makes it convenient for students to obtain study material and monitor progress effectively. The Winning Strategy: Integration, Not Competition Strategic Supplement: Coaching Material Time Management Balance Students must dedicate about 70-80% of their study duration to ICAI material and utilize coaching material for 20-30% of their preparation period. This is done to have a strong base in place while experiencing further insights and practice chances. Some factors make coaching the ideal choice for passing the CA exam The preparedness of each subject The CA curriculum has a wide range of topics. The Coaching Institutes engage professors from a variety of fields, including Chartered Accountants, Cost Accountants, Lawyers, and Senior Managers from Professional Sectors, to make studying all subjects as simple as practicable. So, students will get the opportunity to learn from experts in a very easy manner. A good study environment The setting in which you study has a significant impact on learning. When students study in an appropriate setting, anyone can learn more. Students can find the best possible learning atmosphere at coaching facilities. They can perform better on tests if they can learn more. Curriculum materials A good coaching center, like Parag Gupta Classes, will enable students to get study materials of the highest caliber. These are made with the help of experts, so students can only expect the best. Enhancing Learning Skills The CA Coaching centers strive to increase students’ skills by keeping a high level of professional learning. Besides their own ambition to raise the rank. Student evaluations improve the coaching’s reputation. Both the coaching center and the students can achieve their goals in this manner. Tips and strategies There are constantly a few shortcuts and methods for answering particular problems. Which students can get with the help of experts? Thus, it is best to use the method that will allow people to save a few minutes rather than waste valuable time on exams. Only learners who are registered in a reputed coaching center like Parag Gupta Classes get this privilege. Revision The institutes periodically hold review and restatement courses on a variety of subjects to help students refresh their memory. Beyond everything, the schedule will be finished on time, and you will have time for review. To succeed while taking the CA test, preparation is necessary. Students will remember information better if you make various revisions. Expert advice Students will receive training from subject-matter specialists at the coaching center. Furthermore, they will be prepared to address any questions or issues that may have and point out any blunders that may be doing. The professionals will be available to you whether you need extra help to graduate or are having trouble with one topic. You’ll be prepared for anything that comes your way since you have a team of professionals guiding you at every turn. For existing and upcoming Ph.D. students, the coaching center is a crucial resource for help. Study from the best ICAI Books for all levels of CA exams. Conclusion The road to success in CA is not between coaching material and ICAI study material, but in applying them strategically in combination. ICAI study material has to be the undisputed sovereign as it delivers the authoritative content and exam-focused approach required for success. Quality coaching material like Parag Gupta Classes is an invaluable complement that facilitates deeper understanding, adds variety to practice, and provides strategic examination insight. Remember, the best coaching material should make ICAI concepts easier to understand and remember, not replace them. By maintaining this balance and recognizing the supreme importance of ICAI resources while leveraging quality coaching supplements, CA students can optimize their preparation and maximize their chances of examination success. FAQ‘s